October 2024

News & Notes from DDI

OON, QPA, IDR, & RBP under NSA

Lions, Tigers and BUCAHs, oh my…

As the Texas Medical Association (TMA) notches legal victories against the Department of Health and Human Services (HHS), many are wondering what’s next for Qualifying Payment Amounts (QPAs) in Out-of-Network (OON) reimbursement? In the August win, the 5th Circuit Court of Appeals upheld a district court’s decision favoring providers over payers in how the No Surprises Act (NSA) calculates OON QPAs.

The crux of the disagreement is that when negotiations between payer and provider fail in the Independent Dispute Resolution (IDR) process, arbiters were instructed to use a QPA supplied by the payer, defined as the median in-network contracted rate for the service locally, as guiding force.

In healthcare, unfortunately, a ‘contracted’ rate does not necessarily reflect reality.

The court found that federal agency exceeded their authority under NSA, leading to a vacating of the rules that arbiters first consider the QPA and accept the closest offer.

When contracts don’t reflect markets

As part of the movement toward price transparency, HHS now requires health plans to disclose negotiated prices in Machine Readable Files (MRFs) by procedure and provider. In theory, a median, in-network rate should represent a fair, out-of-network reimbursement, and can be verified via MRF.

What’s not to like? The problem is that many (most) of these ‘contracted’ rates are attached to NPIs who do not provide the listed service.

The best price in your PPO plan for a lumbar discectomy in Dallas, TX, may be attached to a gastroenterologist rather than a spine surgeon. It may be ‘contracted’, but good luck with the surgery. Your money (for discectomy) is no good there (at any price). But how about a colonoscopy? Anyone?

Oh, those evil payers… Lions, tigers and bears, oh my!!

This inevitable refrain – blame the BUCAH’s – echoes from service providers at conferences, stakeholder Zooms, and office water coolers (yes, I still use them); it must be nefariousness! This article does not absolve (nor accuse) anyone of wrongdoing, but there are legitimate reasons for this to happen.

Picture a world where payers have their own proprietary fee schedules with target reimbursement rates for in-network providers by procedure and location. As they build networks, they’d love all providers to be price-takers, agreeing to their proposed rates without negotiation (not unlike Medicare).

Back here on Earth, providers – especially big ones, and where competition is limited – negotiate. But they only negotiate on reimbursement codes they might bill for. And they don’t negotiate down.

The gastroenterologist doesn’t care what the reimbursement rate is for discectomy, but he (and she) wants to get paid more for colonoscopies.

The result is that most providers have full, contracted fee schedules but perform limited services. The services they do provide are negotiated up from the base.

Ghost rates, yes. Lions, tigers and bears, no más.

This is why TMA has prevailed on the lawsuit, and HHS needs to rethink the definition of QPA. The biggest problem with transparency – publishing prices – is excluding any measure of volume.

The impact of ‘ghost rates’

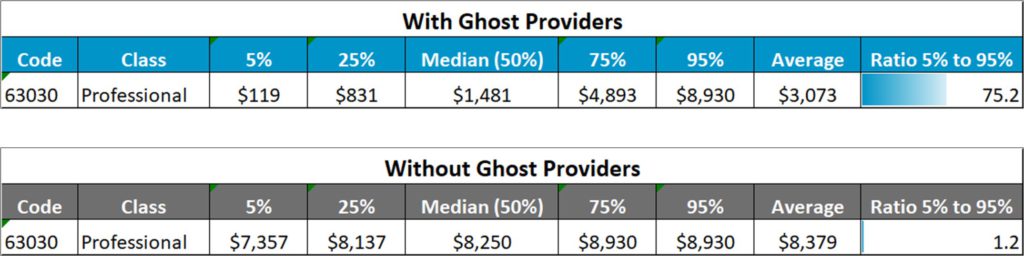

Last March, we published one of the more egregious examples, lumbar discectomy (63030) among five payers in New York City, where exclusion of ghost rates (verifying against utilization and billing data) resulted in nearly a 6x multiple of median contracted rates for providers billing spine surgery–

Prior to the TMA ruling, this implied a QPA discounted by more than 83% of true market rates.

After that article, customers asked if it’s appropriate to simply multiply medians from the MRF’s by 5-6x to get a true representation of in-network reimbursement. Frankly, no.

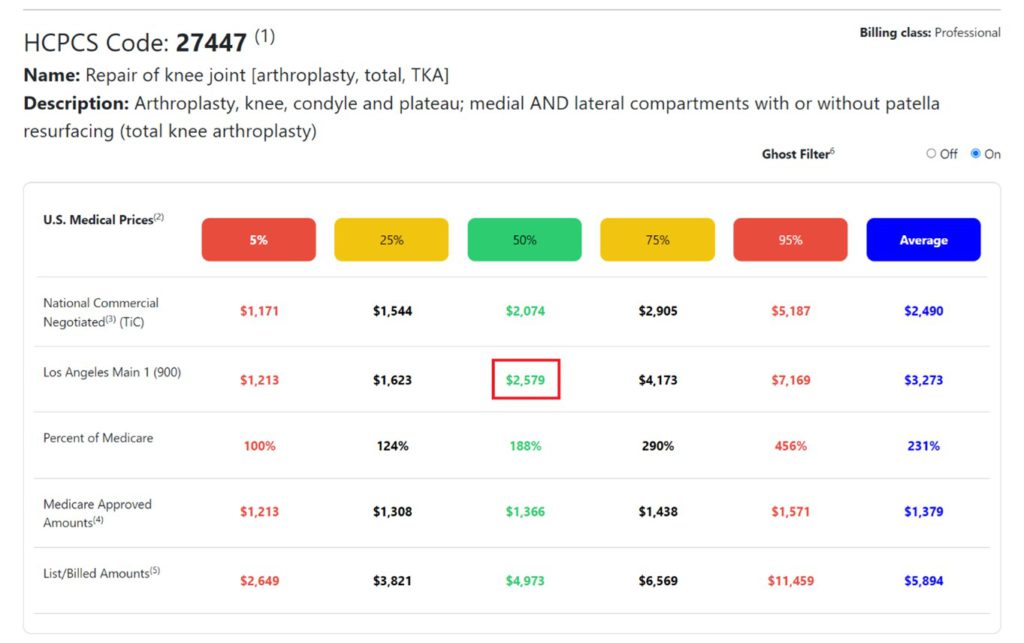

In some ways, the market is already moving in this direction with the trend toward Reference-Based Pricing (RBP) plans. RBP is a healthcare cost management strategy that is increasingly serving as an alternative to traditional Preferred Provider Organization (PPO) networks in commercial healthcare.

In RBP, plan sponsors and their service providers set a fixed reference price they are willing to pay for each procedure. Traditionally, this was calculated as a multiple of Medicare, but with publication of payer negotiated in-network rates, a true market-based qualifying payment amount can now be used.

The key, of course, is to remove trick from treat, leveraging billing data to remove ghosts. Otherwise, the distortions in the MRFs are massive and unpredictable, and the signal is lost in the noise.

Lions, tigers and BUCAHs, oh my!

For more like this, join our email list at: http://34.27.2.8/email-list-form/

About the Authors:

Phil LeFevre is Vice President of Business Development for Denniston Data Inc (DDI), and former Managing Director of ODG by MCG Health (where he remains in advisory capacity). Phil’s background at ODG was to unify evidence-based medicine with claims data analytics to improve outcomes and reduce friction, a relentless focus on workflow integration and customer experience. He brings these skills to DDI to help payers, providers, plan sponsors, and members identify the best doctors at the best prices by procedure, location, or plan using actual, negotiated rates and unbiased, data-driven quality metrics.